- Published: May 29th, 2024

- Last Updated: June 12th, 2025

Attorney Sean T. Keith has been a personal injury lawyer for 30+ years, a nationally recognized Top 100 Trial Lawyer, and top car accident lawyer & motor vehicle accident lawyer in Arkansas.

Legally Reviewed

This article has been written and reviewed for legal accuracy and clarity by the team of writers and attorneys at Keith Law Group and is as accurate as possible. This content should not be taken as legal advice from an attorney. If you would like to learn more about our owner and experienced injury lawyer, Sean T. Keith, you can do so here.

Fact-Checked

Keith Law Group does everything possible to make sure the information in this article is up to date and accurate. If you need specific legal advice about your case, contact us. This article should not be taken as advice from an attorney.

Sean Keith's Accollades & Practice Areas He Specializes In

- Over $20 Million recovered in Medical Device Injury Lawsuits.

- Over $13 Million recovered in Car Accident Lawsuits and other Motor Vehicle Accident Lawsuits.

- Over $100 Million recovered in total on behalf of clients.

- Sean represents clients in cases involving personal injuries, car accidents, motorcycle accidents, truck accidents, wrongful death, slip and falls, nursing home abuse cases, nursing home elopement cases, and more.

Overview of Who Pays Medical Bills After a Car Accident in Arkansas

On this page, we’ll discuss who pays for my medical bills after a car accident in Arkansas, the role of an Arkansas car accident lawyer in recovering medical expenses, steps to take to ensure your medical bills are paid, and much more.

Intro to Who Pays Medical Bills After a Car Accident in Arkansas

Common medical expenses after a car accident may include:

- Emergency Room Visits: Severe crashes often result in ambulance trips and emergency treatment.

- X-rays, CT Scans, and MRIs: These tests help identify injuries that may not be immediately apparent.

- Surgery and Rehabilitation: More serious injuries could require surgical intervention and extensive rehab.

- Ongoing Care: You may need to see various doctors and specialists for some time after the accident.

If you or a loved one has been injured in an Arkansas car accident, consulting an experienced Arkansas car accident attorney can help you understand your legal options to pursue compensation.

Contact Keith Law Group using the chat on this page to receive an instant case evaluation to determine your eligibility to recover damages after a car accident in Arkansas.

Table of Contents

The Role of an Arkansas Car Accident Attorney to Ensure You Get Compensated Fairly

One of the most important things to understand after a car accident is the role of your personal injury attorney.

Your lawyer’s primary duty is to advocate for your interests and help you pursue the maximum compensation available.

Your attorney should prioritize your needs in the following ways:

- Provide Advice: This includes guidance on dealing with insurance companies and getting appropriate medical care.

- Gather Evidence: Your lawyer will investigate the accident, collect records, and interview witnesses.

- Handle Communication: Having your attorney manage these interactions helps protect your claim.

- Negotiate Settlement: Most car accident cases end in settlement, and your attorney’s negotiation skills are key.

With your lawyer shouldering these burdens, you can focus on your physical recovery with greater peace of mind.

Always remember that your attorney works for you and you alone.

Your Lawyer Should Prioritize Your Interests Above All Else

Your personal injury lawyer must remain loyal to you throughout the legal process.

While your attorney may interact with many other parties after an accident, they must put your needs first.

Your lawyer should not be unduly influenced by any of the following:

- Other Driver’s Insurer: The at-fault party’s insurer will look for ways to minimize their payout.

- Your Insurance Providers: Even your own insurer may try to limit their financial obligations after an accident.

- Medical Providers: While your attorney may communicate with your doctors, their primary interest is your well-being, not the doctors’ payment.

- Other Third Parties: Your lawyer must avoid conflicts of interest and always act in your best interests.

You are your attorney’s sole priority as they work to help you recover damages.

Be wary of lawyers who seem to have divided loyalties.

Advice from Your Attorney to Maximize Your Compensation

To give yourself the best chance at receiving full and fair compensation, follow your lawyer’s advice after an accident.

Some of the most important guidance your attorney will provide relates to your medical care.

Your lawyer will likely advise you to do the following:

- Seek Medical Attention: Don’t delay getting checked out by a doctor, even if you feel okay. Some injuries take time to manifest symptoms.

- Follow The Treatment Plan: Attend all follow-up appointments and therapy sessions to demonstrate the seriousness of your injuries.

- Avoid Recorded Statements: Your lawyer should handle communication with the insurance companies to avoid damaging your claim.

- Document Injuries and Expenses: Keep detailed notes and records of how the accident and injuries have impacted your life. By following your attorney’s advice, you can improve your chances of recovering compensation for all of your accident-related expenses, including medical bills.

If you or a loved one has been injured in an Arkansas car accident, consulting an experienced Arkansas car accident attorney can help you understand your legal options to pursue compensation.

Contact Keith Law Group using the chat on this page to receive an instant case evaluation to determine your eligibility to recover damages after a car accident in Arkansas.

Avoid Letting Hospitals Bill the Other Driver's Insurance Directly

After a car accident, it’s common for healthcare providers to offer to bill the at-fault driver’s insurance company directly.

While this may seem convenient, it can actually work against you.

Hospitals and doctors’ offices may try to bill the other insurance company because of the following reasons:

- Faster Payment: The at-fault party’s insurance may be seen as a guaranteed source of payment.

- No Out-of-Pocket Costs: Providers may think they are doing you a favor by not asking for payment upfront.

- Lack of Legal Knowledge: Many healthcare administrators do not understand how car accident billing works.

- Simplified Billing: Dealing directly with the liability insurer may seem simpler for the provider’s staff.

Despite the perceived benefits, allowing your providers to bill the other party’s insurer can have significant drawbacks for you as the patient and plaintiff.

Why Hospitals May Offer to Bill the Other Driver’s Insurance

When a healthcare provider learns that your injuries stem from a car accident, they will likely ask for the at-fault driver’s insurance information.

If you provide this information, the billing office will probably submit the charges directly to that insurer.

Providers may be eager to bill the other party’s insurance for reasons like:

- Avoiding Complications: Submitting a claim to health insurance requires following strict protocols and coding procedures.

- Avoiding Discounts: Most health insurers have negotiated reduced rates with providers, which cuts into the provider’s bottom line.

- Recovering Full Amount: If the provider bills the at-fault party’s insurer, they may assume they’ll be paid in full.

- Securing Quick Payment: The provider may believe the liability insurer will not scrutinize the charges as closely as health insurance.

While it’s understandable that healthcare organizations want to collect payment for their services, billing the liability insurer is not in your best interest as the injured party.

The Pitfalls of Not Using Your Own Health Insurance Coverage

Although your providers may urge you to let them bill the other driver’s insurance company, this approach can seriously undermine your injury claim.

It’s almost always better to provide your own health insurance information if you have it.

The downsides of letting your providers bill the other party’s insurer include the following:

- Settlement Deductions: The liability insurer will subtract your entire medical bill from your compensation, leaving you with less money in your pocket.

- Loss of Discounts: When you use health insurance, you get the advantage of the reduced rates they’ve negotiated with providers.

- Potential Out-of-Pocket Costs: If your claim is denied or your settlement doesn’t cover the full billed amount, you could be responsible for the balance.

- No Payment Obligation: The liability insurer does not have to pay your providers directly or promptly.

Using your own health insurance helps pay your bills while increasing your potential net compensation.

Let your lawyer deal with the other driver’s insurance company.

Importance of Using Your Own Health Insurance After a Car Accident in Arkansas

If you have health insurance, either through your employer or an individual policy, it’s crucial to use that coverage after a car accident.

Doing so can significantly reduce the amount that will be taken out of your injury settlement.

Key reasons to use your own health insurance for accident-related medical care:

- Discounted Rates: Health insurers have contracts with providers to pay reduced amounts for services.

- No Upfront Payment: When you use health insurance, the provider should only bill you for your copay or deductible.

- Reimbursement from Settlement: Your health plan will be reimbursed out of your compensation but at a discounted rate.

- Focus on Treatment: With your health insurance covering your care, you can concentrate on getting better.

Don’t let your providers convince you to bill the other party’s auto insurance.

Insist that they submit the charges to your health insurer instead.

Why Using Your Own Health Insurance is Crucial Following a Crash

To illustrate the importance of using health insurance after an accident, consider an example.

Let’s say your post-accident emergency room bill totals $5,000.

If that $5,000 bill is submitted to the at-fault driver’s insurance:

- Settlement Deductions: The liability insurer will subtract $5,000 from your compensation for that bill alone.

- Loss of Discounts: If your health insurer has a contract with the ER, they might have only paid $2,500 for the same services.

- Risk of Responsibility: If the other driver’s insurer refuses to pay, you could be stuck with the entire $5,000 bill.

- Payment Delays: The liability insurer has no obligation to pay your providers in a timely manner.

In contrast, if you use your health insurance, your net compensation will likely be higher, and you’ll avoid the risk of having to pay the full billed amount out of pocket.

How Billing the Other Driver’s Insurance Can Reduce Your Payout

Failing to use your own health insurance can take a big chunk out of your eventual settlement or jury award.

The difference can easily amount to thousands of dollars.

Examples of how using health insurance can increase your compensation:

- Hospital Bill Reduction: A $50,000 hospital bill may be reduced to $20,000 if your health insurer has negotiated a 60% discount with the hospital, saving you $30,000.

- MRI Cost Reduction: A $1,000 MRI might only cost $400 if your health plan has a contracted rate that is 60% lower than the billed amount.

- Small Copay or Deductible: Instead of paying the full bill, you may only have to cover a $50 copay or a $500 deductible.

- Reimbursement at Reduced Rate: When your settlement is paid out, your health plan will be repaid at the discounted amount, not the full billed charges.

These discounts can add up over the course of your medical treatment, leaving you with significantly more money in your pocket at the end of your case.

How Health Insurance Contracts Can Significantly Reduce Medical Bills

Most health insurance companies have contracts with hospitals, doctors, and other providers in their network.

These contracts allow the insurer to pay a reduced rate for services in exchange for access to the insurer’s members.

Typical discounts included in health insurance contracts:

- Hospital Discounts: Hospitals may accept 50-70% less than their standard rates. For example, a $10,000 hospital bill may be reduced to $3,000-$5,000.

- Doctor Reductions: Doctors may agree to 40-60% reductions. Under the health plan contract, a physician’s $500 bill could be cut to $200-$300.

- Imaging and Lab Discounts: Imaging centers, labs, and other providers also offer discounts. An MRI facility might cut their $2,000 charge to $800 for health plan members.

- Reduced Prescription Costs: Your health plan may have negotiated rates with pharmacies or pharmaceutical companies.

These contractual adjustments can make a huge difference in the overall cost of your medical care after an accident.

The discounts your health plan has secured can translate into a much larger net settlement.

The Discounts Health Insurance Companies Negotiate with Providers

The discounts included in health insurance contracts are often significant.

It’s not uncommon for providers to accept 50% or more off their standard charges.

Factors that influence the size of the discounts insurers can negotiate:

- Insurer’s Membership Size: Large health plans with many members have more leverage to negotiate bigger discounts.

- Provider’s Market Share: Providers with less market power may be more willing to accept reduced rates to access an insurer’s members.

- Type of Provider and Services: Some types of providers, like hospitals, may have more room to offer discounts than others.

- State and Federal Regulations: Laws governing health insurance and provider contracts can impact negotiated rates.

When you use your health insurance after an accident, you get the benefit of these discounted rates, which can dramatically reduce your medical expenses.

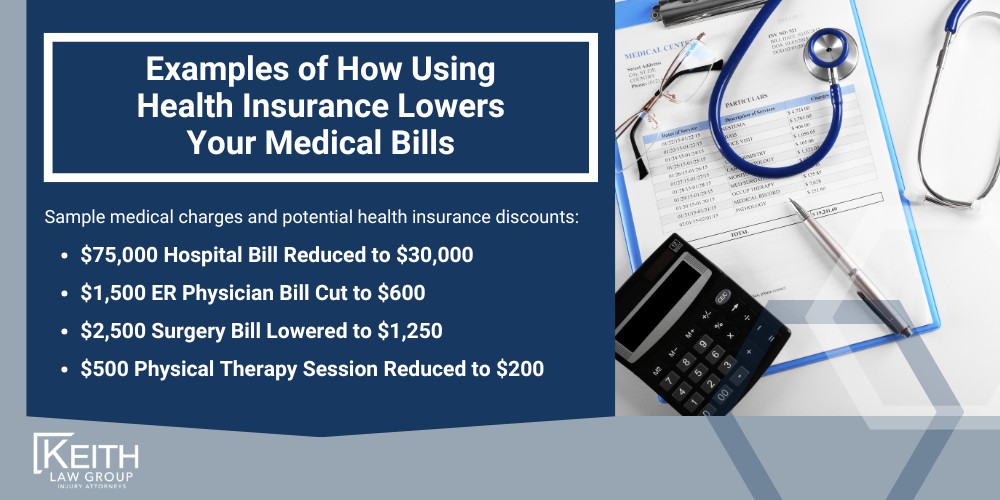

Examples of How Using Health Insurance Lowers Your Medical Bills

To better understand how health insurance discounts work, consider a few examples of common car accident medical bills.

Sample medical charges and potential health insurance discounts:

- $75,000 Hospital Bill Reduced to $30,000: If your health plan has negotiated a 60% discount with the hospital, you save $45,000.

- $1,500 ER Physician Bill Cut to $600: Under the provider’s contract with your health insurer, they may accept a 60% reduction, saving you $900.

- $2,500 Surgery Bill Lowered to $1,250: If your health plan has a 50% discount for surgical procedures, you save $1,250.

- $500 Physical Therapy Session Reduced to $200: Your health insurer may have negotiated a 60% discount for PT, saving you $300 per visit.

These examples demonstrate how the discounts included in health insurance contracts can significantly reduce your medical expenses after an accident.

Over the course of your treatment, the savings can be substantial.

Reduced Medical Bills Lead to Higher Compensation for Your Car Accident in Arkansas

The amount of your medical bills directly impacts the value of your Arkansas car accident claim.

The lower your bills, the more compensation you’ll likely receive for your other damages.

Reasons lower medical expenses result in higher net settlements:

- Deduction from Payout: The at-fault party’s insurance will subtract your medical expenses from your total compensation.

- Discounted Amounts Deducted: When you use health insurance, the discounted amounts are deducted, not the full billed charges.

- More for Other Damages: With lower medical bills, you may be able to demand more for pain and suffering, lost wages, and other damages.

- Faster Claim Resolution: When your medical expenses are lower, the at-fault party’s insurer may be more willing to settle quickly.

Using your health insurance and securing discounts on your medical care can significantly increase your take-home compensation after an accident.

Why Lower Medical Bills Matter When Settling Your Injury Claim

Any car accident claim aims to recover the maximum compensation possible for your injuries and other damages.

The amount of your medical bills plays a big role in determining that compensation.

How lower medical expenses can impact your injury settlement:

- Larger Percentage of Demand: With lower bills, the at-fault party’s insurer may be more likely to pay a higher percentage of your initial demand.

- More Room to Negotiate: Lower medical expenses allow you to negotiate other aspects of your settlement, like pain and suffering damages.

- Avoid Lengthy Trial: If your bills are lower, the other side may be more willing to settle out of court to avoid the expense of a trial.

- More Money in Pocket: The lower your medical expenses, the more of your settlement you get to keep for yourself.

Reducing your medical bills by using health insurance can significantly improve your financial recovery after an accident.

It’s one of the most important steps you can take to protect your claim.

How the Insurance Adjuster Evaluates Your Medical Expenses

When you submit a car accident claim to the at-fault driver’s insurance company, the adjuster assigned to your case will carefully review your medical bills and records.

They will use this information to determine how much to offer you in settlement.

Factors the adjuster considers when evaluating your medical expenses:

- Total Amount of Bills: The higher your bills, the more the adjuster will likely offer in settlement, up to the policy limits.

- Reasonableness and Necessity: The adjuster will seek evidence that your medical care was appropriate for your injuries.

- Types of Providers: If you received treatment from specialists or surgeons, the adjuster may value your claim more.

- Duration of Treatment: The duration of your medical care can impact the adjuster’s evaluation of your injuries and expenses.

Using your health insurance and obtaining discounts on your medical bills can make your claim more attractive to the insurance adjuster and increase your chances of receiving a favorable settlement offer.

Who Ultimately Pays Your Medical Bills in an Arkansas Car Accident

If you’ve been injured in a car crash that was someone else’s fault, you may be wondering who is responsible for paying your medical bills.

The answer depends on the specific circumstances of your case.

Parties that may be liable for your medical expenses after an accident:

- At-Fault Driver’s Insurance: If the other driver caused the crash, their liability insurance should cover your medical bills up to the policy limits.

- Your Health Insurance: If you use your health insurance to pay for accident-related treatment, your insurer will likely seek reimbursement from your settlement.

- Your Auto Insurance: If your auto policy includes medical payments coverage or personal injury protection (PIP), it may pay some of your bills.

- At-Fault Driver Personally: If the other driver was uninsured or underinsured, you may need to pursue compensation from them directly.

In most cases, the at-fault party’s insurance will be the primary source of payment for your medical expenses.

However, the process of getting those bills paid can be complex.

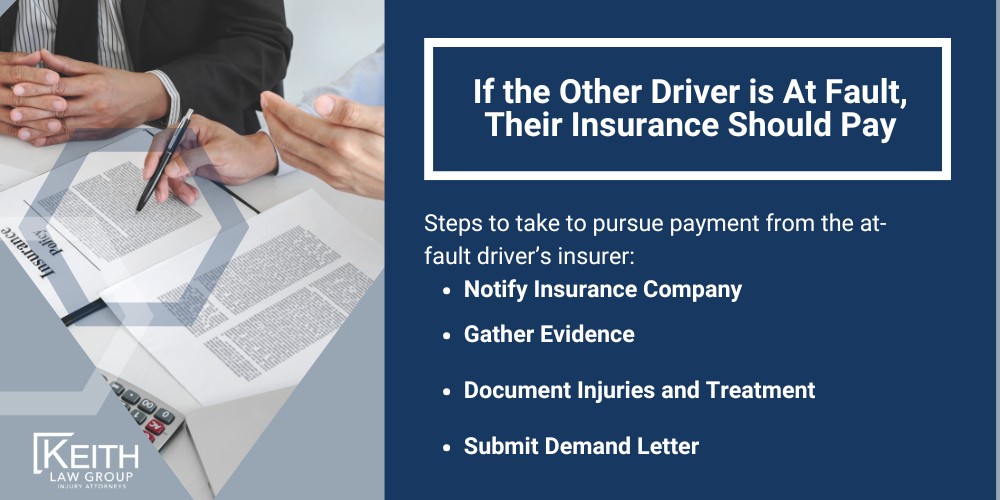

If the Other Driver is At Fault, Their Insurance Should Pay

When another driver causes an accident that injures you, their auto liability insurance is typically responsible for your damages, including your medical bills.

However, getting the insurance company to pay can be a challenge.

Steps to take to pursue payment from the at-fault driver’s insurer:

- Notify Insurance Company: Your attorney can handle this process to protect your rights.

- Gather Evidence: Your lawyer will collect police reports, witness statements, and other proof of the other driver’s fault.

- Document Injuries and Treatment: Keep detailed records of your medical care and expenses related to the accident.

- Submit Demand Letter: Your attorney will draft a letter outlining your damages and demanding fair compensation.

If the insurance company refuses to offer a fair settlement, your lawyer may advise you to file a lawsuit to pursue the compensation you deserve.

You Receive the Remainder After Medical Bills Are Paid

When you receive a settlement from the at-fault party’s insurance company, the money will first be used to pay any outstanding medical bills related to the accident.

You will then receive the remaining funds.

How your settlement funds will be distributed:

- Health Insurance Reimbursement: If you use health insurance to pay for your treatment, your insurer will be paid back from your settlement.

- Auto Insurance Reimbursement: If your auto policy covers any of your medical bills, your insurer will also be repaid.

- Attorney Fees and Costs: Most car accident lawyers work on a contingency fee basis, meaning they only get paid if you recover compensation.

- Net Settlement Proceeds: After all of the bills, liens, and fees have been paid, you will receive the remaining money.

The larger your settlement and the lower your medical expenses, the more money you will ultimately receive in your pocket.

That’s why using your health insurance and working with an experienced attorney is so important.

Contact Keith Law Group for Guidance After an Arkansas Crash

The legal process of pursuing compensation after a car accident can be overwhelming, especially when you’re dealing with injuries and mounting medical bills.

Keith Law Group can assist with your Arkansas car accident claim:

- Investigate and Gather Evidence: We will thoroughly investigate the crash and build a strong case for compensation.

- Handle Communication: Our team will deal with the insurers on your behalf to protect your rights.

- Negotiate Settlement: We will fight for the maximum compensation available in your case.

- Take Case to Trial: If the insurance company won’t make a fair offer, we are prepared to argue your case in court.

With Keith Law Group on your side, you can focus on your recovery while we handle the legal details of your claim.

The Importance of Getting Legal Advice Following an Accident

One of the most important steps you can take after a car accident is to consult with an experienced personal injury attorney.

A lawyer can provide valuable guidance on a wide range of issues, from getting proper medical care to dealing with insurance companies.

Reasons to seek legal advice after a car crash:

- Protect Right to Compensation: An attorney can help you avoid common mistakes that could hurt your claim.

- Handle Medical Bills Correctly: A lawyer can advise you on using your health insurance and dealing with medical liens.

- Negotiate with Insurers: An experienced attorney knows how to deal with insurance adjusters and fight for a fair settlement.

- Take Case to Court: If the insurance company won’t make a reasonable offer, a lawyer can file a lawsuit and argue your case before a judge and jury.

Don’t try to handle the aftermath of a serious car accident on your own.

Contact Keith Law Group today to schedule a free consultation with one of our knowledgeable attorneys.

Always Use Your Health Insurance When Seeking Medical Treatment

If you take away one piece of advice from this article, let it be this: always use your health insurance when seeking medical treatment after a car accident.

Doing so can significantly reduce your medical expenses and increase your ultimate compensation.

Benefits of using health insurance for accident-related medical care:

- Pay Less Out of Pocket: Your health plan should cover most of your treatment costs, leaving you with only a copay or deductible to pay.

- Negotiated Discounts: Health insurers have contracts with providers that allow them to pay reduced rates for services.

- Keep More Settlement Money: The lower your medical bills, the more compensation you’ll likely receive for your other accident-related damages.

- Focus on Treatment: With your health insurance covering your care, you can focus on getting better.

Don’t let a healthcare provider convince you to bill the at-fault driver’s insurance directly.

Insist on using your health insurance, and let your personal injury attorney handle the rest.

If you’ve been injured in a car accident in Arkansas, the attorneys at Keith Law Group are here to help.

Contact us today to schedule a free consultation and learn more about your legal rights and options.

We have the knowledge and experience to guide you through the legal process of pursuing compensation for your medical bills and other damages.

Frequently Asked Questions

-

Who pays my medical bills after a car accident in Arkansas?

If the other driver is at fault, their insurance company should ultimately be responsible for your medical bills.

However, your own health insurance and car insurance may provide initial coverage.

An experienced Arkansas car accident attorney can help ensure you receive proper compensation.

-

How can an Arkansas car accident attorney help with my medical bills?

An Arkansas car accident attorney can provide valuable advice on using your health insurance to cover medical bills, gather evidence to support your claim, handle communication with insurance companies, and negotiate a fair settlement that includes compensation for your medical expenses.

-

Should I let the hospital bill the other driver's insurance directly?

No, it’s generally better to use your own health insurance to cover your medical bills after a car accident in Arkansas.

Billing the other driver’s insurance directly can reduce your final settlement amount.

An Arkansas car accident attorney at Keith Law Group can help you through the billing process.

-

How does using my health insurance affect my car accident settlement?

Using your own health insurance to cover medical bills after a car accident in Arkansas can significantly increase your final settlement amount.

Health insurance companies negotiate discounted rates with providers, reducing the amount that will be deducted from your settlement.

Your Arkansas car accident attorney can advise you on maximizing your compensation.

-

What happens to my medical bills when I receive a car accident settlement?

When you receive a settlement after a car accident in Arkansas, the funds will first be used to pay any outstanding medical bills related to the accident.

Your health insurance and auto insurance may be reimbursed, and your attorney’s fees will be deducted.

You will then receive the remaining amount.

An Arkansas car accident attorney can help ensure you receive the maximum compensation possible.

All Posts for the Car Accident Lawsuit Legal Guide

Practice Areas

- 3M Earplug

- Belviq

- Bladder Sling

- Camp Lejeune Water Contamination

- Defective Medical Device

- Hernia Mesh

- Hip Replacement

- NEC Infant Formula

- Medtronic Insulin Pump

- Paraquat

- Philips CPAP

- Roundup

- Talcum Powder

- Tylenol Autism & ADHD

- Zantac

- Bicycle Accidents

- Boat Accidents

- Construction Accidents

- Dog Bite

- Drug Injuries

- Electric Shock Injuries

- Nursing Home Abuse

- Nursing Home Bedsore

- Nursing Home Falls

- Nursing Home Infection

- Nursing Home Sexual Abuse

- Personal Injuries

- Premises Liability

- Slip and Fall

- Traumatic Brain Injuries

- Wrongful Death

- 3M Earplug

- Belviq

- Bladder Sling

- Camp Lejeune Water Contamination

- Defective Medical Device

- Hernia Mesh

- Hip Replacement

- NEC Infant Formula

- Medtronic Insulin Pump

- Paraquat

- Philips CPAP

- Roundup

- Talcum Powder

- Tylenol Autism & ADHD

- Zantac

- Bicycle Accidents

- Boat Accidents

- Construction Accidents

- Dog Bite

- Drug Injuries

- Electric Shock Injuries

- Nursing Home Abuse

- Nursing Home Bedsore

- Nursing Home Falls

- Nursing Home Infection

- Nursing Home Sexual Abuse

- Personal Injuries

- Premises Liability

- Slip and Fall

- Traumatic Brain Injuries

- Wrongful Death

You pay

Nothing

unless we win

Do You Have A Case?

Recent Legal Posts & Articles

Recent Legal Guides

Choose Us For Your Personal Injury Case

- Available 24/7

- No Upfront Fees

- Free Case Evaluation

- No Fees Unless We Win!