While you might have to wait a while to receive a payout when a loved one passes during the contestability period, insurers will most likely compensate if there’s no evidence of intentional inaccuracies or fraud.

However, if during their investigation they uncover a problem, no matter how small, chances are it’ll affect the payout.

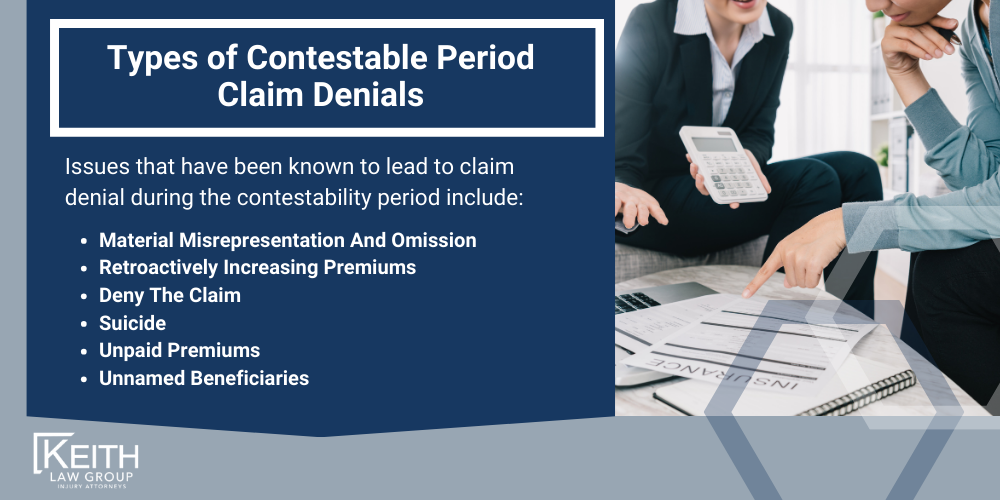

Issues that have been known to lead to claim denial during the contestability period include:

Material Misrepresentation and Omission

Insurance companies that offer life insurance are always searching for material misrepresentation and omissions on a policyholder’s application. Material misrepresentation refers to statements made by an individual with the intent to mislead or deceive, with information that’s vital to the issue at hand. In short, the information provided could have affected how the insurance company classified the individual’s level of risk or would have or if they should have denied them coverage.

There are several ways that insurance companies respond to material misrepresentation, and it all depends on the severity of the inaccuracy or omission. These include:

Retroactively Increasing Premiums

If the omitted information means that the insurer would have classified the policyholder as high risk, the company might opt to retroactively adjust what they’d have required the holder to pay in premiums. In such an event, the company might opt to withhold the difference in premiums from the amount they payout.

Deny the Claim

If the insurer finds major issues that would have forced them not to offer the policyholder coverage, they could deny the claim. For instance, if your loved one had been diagnosed with cancer and they misrepresented the date on their application, that could cause the insurer to deny your claim as a beneficiary.

Insurance companies are required to provide proof of fraud at the end of the contestable period before they can deny a claim on misrepresentation grounds. If you find yourself in such a situation, a professional life insurance dispute lawyer can help ensure that the insurance company plays by the rules. Get in touch with Keith Law Group today for legal counsel you can rely on and expert representation.

Suicide

Most life insurance policies also include something known as a suicide clause. While this clause extends over the contestable period, it’s a distinct clause on its own. It is worth noting that contestability allows insurance companies to investigate a policyholder’s cause of death. However, if, from their investigations, the insurer discovers that the policyholder took his or her own life, the suicide clause gives the insurance provider the power to deny claims filed by the holder’s beneficiaries.

The suicide clause exists for one reason, and that is to deter people from buying life insurance policies so they take their lives and leave cash to those listed as beneficiaries. It is also worth noting that the clause also applies to legal right-to-die situations. If you are currently embroiled in a tussle with an insurance provider that’s refuting the cause of your loved one’s death and has denied your claim, consult the professional Arkansas life insurance dispute attorneys at Keith Law Group for assistance and guidance. Call (479) 326-7734 now!

Unpaid Premiums

Insurance companies will sometimes claim that the policyholder missed several payment payments or paid them late. In Arkansas, policyholders have a thirty-day grace period to pay their premiums. As such, some of the payments that the insurance company is talking about aren’t late. An attorney from Keith Law Group can help you dispute unpaid premium claims.

Unnamed Beneficiaries

Even if there aren’t any beneficiaries listed in a policy, the person’s estate still reserves the right to inherit the benefits.

While this might call for you to go through probable, a lawyer could help you, and your family, claim the policy’s benefits.